stamp duty act malaysia 2017

Short title and commencement 1. Gallery Stamp Duty Exemption Malaysia 2021 Housing Loan Latest ArticleNews.

Historically much of malaysian tax and revenue.

. This section of the article is only. Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan. Stamp duty on foreign currency loan agreements is generally capped at RM2000.

163 Jalan Sungei Besi 57100 Kuala Lumpur Malaysia Stamp Duty Changes by Ong Eu Jin and Christine Chan Ee Yin The Bill for the Stamp Amendment Act 2016 Amendment Act tabled before Parliament late last year1 seeks to introduce substantial changes to the Stamp Act 19492 When passed by Parliament the. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. From the 2017 budget it is announced that stamp duty will be increased to 100 percent on instrument of transfer in order to reduce the cost of ownership for first home owner compared to the current 50 percent exemption.

Stamp Duty Changes 5. The stamp act amendment order 2017 effective from 4th may 2017. In this Act unless the context otherwise requires advocate means any person entitled to practise as an advocate or as a solicitor or as an advocate and solicitor under any law in any part of Malaysia.

For this purpose the Collector may require the instrument to be fully furnished with all other necessary or supporting documents of evidence. Stamp duty Fee 2. Stamp Duty Exemption Malaysia 2021.

A copy of the following documents are. From a stamp duty perspective the sale of shares in a Malaysian incorporated company will be subject to stamp duty at the rate of 03. Sila rujuk pautan berikut untuk maklumat lanjut.

This article first appeared in The Edge Malaysia Weekly on January 16 - 22 2017. Sabah and Sarawak 1 October 1989 PU. ENACTED by the Parliament of Malaysia as follows.

Peninsular Malaysia 5 December 1949. An Act to provide for the imposition of stamp duties fees and penalties in respect of certain instruments to provide for the stamping of such instruments to provide for the management of stamp duties fees and penalties and for other matters incidental thereto and connected there with. Stamp duty act malaysia 2017 Avian Influenza 2017 Efsa Journal Wiley Online Library Trump Records Shed New Light On Chinese Business Pursuits The New York Times Akmu Summer Episode 2017 Akdong Musician Yg Entertainment Akdong Musician Album Album Songs 2017 Year End Fcpa Update Gibson Dunn 2017 Year End Fcpa Update Gibson.

B 4411989 PART I PRELIMINARY Short title and application 1. Total exemption amount is. STAMP ACT 1949 Click here to see Annotated Statutes of this Act Part I PRELIMINARY SECTION 1Short title and application 2Interpretation 3Collector and Deputy Collectors of Stamp Duties 3APowers of Collector Part II PROVISIONS APPLICABLE TO INSTRUMENTS GENERALLY Chapter Liability of Instruments to Duty SECTION.

2This Act comes into operation on a date to be appointed by the Minister by notification in the Gazette. RM 7000 RM 5000 RM 2000. Stamp duty Fee 1.

So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself. The Stamp Act 1949 Act 378 which is referred to as the. 2 This Act shall apply throughout Malaysia.

RM360 000 X 050 RM1800. Provisions in the stamp act 1949 to accord relief from stamp duty for. What goods are subject to excise duty.

21 an amount according to the loan amount as specified in the schedule shall be remitted from the stamp duty chargeable on any loan agreement to finance the purchase of only one unit of residential property the value of which is not more than five hundred thousand ringgit rm50000000 executed between an individual who is a malaysian. However the exemption is limited to houses valued at a maximum of RM300000 for first time home buyers for a limited time between January next year and December 2018. Non-resident individuals Types of income Rate.

A 365 and Stamp Duty Remission No 2 Order 2016 PU. Nevertheless relief from stamp duty is available for reconstructions or amalgamation of companies or. Home stamp amendment act 2017.

The Stamp Duty Exemption No. For First RM100 000 RM1000. Property Stamp duty.

Sale of assets such as land and receivables will attract stamp duty at rates ranging from 1 to 3. A 366 came into effect on 1 Jan 2017. In other words the balance you need to pay is.

APRIL 2017 1. In this Act unless the context otherwise requires. SOME proposed amendments to the Stamp Act 1949 which seek to impose stricter requirements on the stamping of contracts have caused a stir among property developers who worry that the amendments will push up their cost of doing business.

2 Order 2017 PUA 408 gazetted on 26 December 2017 provides a stamp duty exemption on a contract note executed for the sale and purchase transaction of a structured warrant or exchange-traded fund approved by the Securities Commission SC under the Capital Markets and Services Act 2007. Total Stamp Duty to be paid is. 1 this act may be cited as the stamp amendment act 2017.

Stamp duty act malaysia 2017. RM100 001 To RM500 000 RM6000. Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments without security and repayable on demand or in single bullet repayment.

Under the current act the duty. Stamp Duty To Purchase A Property Stamp Duty For Loan Agreement In an effort to reduce the cost of ownership of first home for Malaysian citizens the government has proposed the following stamp duty exemptions- The below exemption is applicable for sale and purchase agreement executed after 1 January 2021 but not later than 31 December 2025. Amendment of section 2 2.

All instruments chargeable with duty and executed by any person in Malaysia shall be brought to the Collector who shall assess the duty chargeable. Home Stamp Duty Malaysia 2017. 100 loan is possible but uncommon for most people.

You will have to pay rm1 for every rm1k rounded up to the nearest ringgit subject to maximum. Mana-mana orang yang dinyatakan di dalam Perintah Duti Kastam Pengecualian 2017 adalah layak untuk dikecualikan daripada pembayaran duti kastam tertakluk kepada syarat-syarat serta barang-barang yang telah ditetapkan dalam perintah tersebut. 1 This Act may be cited as the Insolvency Act 1967.

Circular No 0372017 Dated 22 Feb 2017 To Members of the Malaysian Bar Stamp Duty Remission Order 2016 and Stamp Duty Remission No 2 Order 2016 Please be informed that Stamp Duty Remission Order 2016 PU. 1 This Act may be cited as the Stamp Act 1949. 2 This Act shall apply throughout Malaysia.

KUALA LUMPUR Oct 21 Prime Minister Datuk Seri Najib Razak announced today a full waiver of stamp duty for first-time home buyers from the current rate of 50 per cent. Laws of malaysia reprint act 360 insolvency act 1967 as at 1 november 2017 published by the commissioner of law revision malaysia under the authority of the revision of laws act 1968 2017. STAMP ACT 1949 An Act relating to stamp duties.

The Collector may refuse to proceed upon any such application until all documents. 1 This Act may be cited as the Stamp Amendment Act 2017. The government has updated the stamp duty policy for property to.

.jpg)

Financing And Leases Tax Treatment Acca Global

Financing And Leases Tax Treatment Acca Global

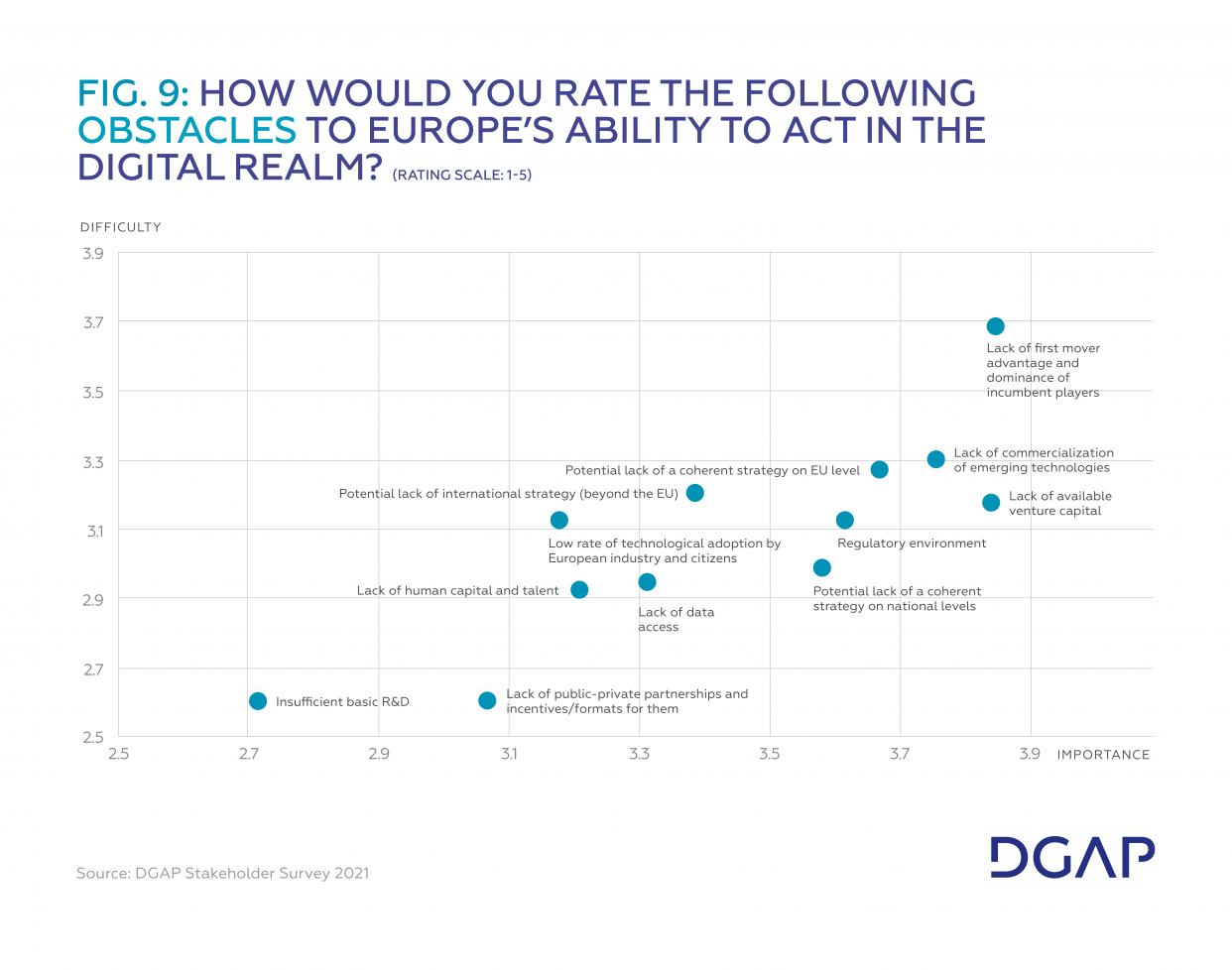

Europe S Capacity To Act In The Global Tech Race Dgap

Regulatory Modes And Entrepreneurship The Mediational Role Of Alertness In Small Business Success Amato 2017 Journal Of Small Business Management Wiley Online Library

.jpg)

Financing And Leases Tax Treatment Acca Global

Pdf The Impact Of Internal Factors On Small Business Success A Case Of Small Enterprises Under The Felda Scheme

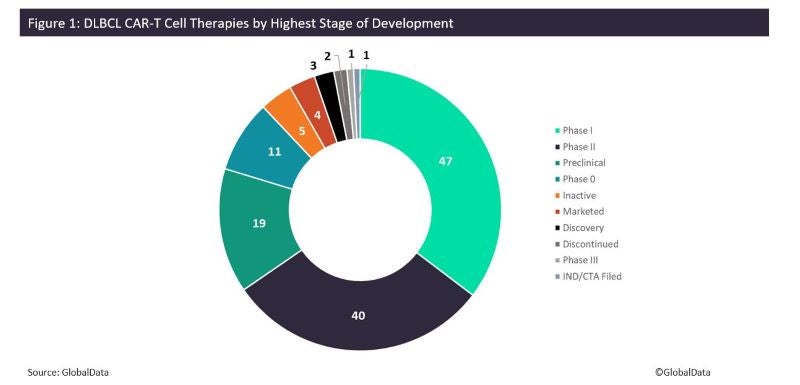

There Is A Large Pipeline Of Car T Cell Therapies For Diffuse Large B Cell Lymphoma Pharmaceutical Technology

Effectiveness Of India S Advance Pricing Agreements

Pdf Proceedings Of The 6th International Conference On Libraries Complete 07032018 Eversion

Comments

Post a Comment